Why UM/UIM Insurance Coverage Is Important

One of the most overlooked, but probably the most important

coverage on your auto insurance is the UM/UIM coverage. Why is it important? UM/UIM coverage goes to cover your medical

bills, rehabilitation, and loss of work if someone injures you in an auto

accident and they don’t have insurance or enough liability insurance to cover

your bills.

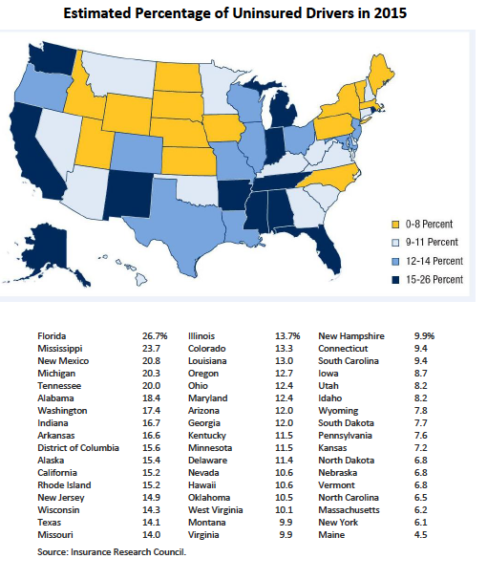

In AZ it is estimated that 12% of the people driving on the

streets don’t have auto insurance according to an insurancejournal.com

report. That is about the same as the

national average. On top of that there

are a lot of people driving around with state minimum coverage or one step

above state minimum. If there is a major

accident this coverage isn’t going to cover everything.

Just to give an example this story from azfamily.com

is about a teacher whose son was hit in an auto accident. He has had to stay in the hospital for a

while and the medical bills, rehabilitation, and loss of work is going to get

very expensive. Having good UM/UIM

coverage will help him recover financially what the accident has taken from

him.

UM/UIM doesn't cover the repairs to fix your vehicle though. That will come from your collision coverage and be subjected to your agreed upon deductible.

Raymond E. Grim is an insurance

agent and owner of Raymond E. Grim Agency LLC with American Family

Insurance. He has been serving the Surprise, AZ area since 2001.

Raymond specializes in auto insurance, home insurance, life insurance, and

business insurance. Raymond is also an active member of the Surprise

Regional Chamber of Commerce. Raymond along with his wife are

also associate pastors for CFTN Surprise. Raymond along with his staff

gives honest and quality service for your insurance needs.

#SurpriseInsuranceAgent

#Insurance #InsuranceAgent #LifeInsurance #AutoInsurance #RentersInsurance

#HomeInsurance #UM/UIM

Comments

Post a Comment